An updated overview on new construction green building rebates for 2023 and beyond.

The Inflation Reduction Act, passed in August 2022, contains generous, unprecedented new funding for energy efficiency for homes, whose energy use currently contributes significantly to US total carbon emissions.

Although much ado has been made about the potential money coming to homeowners (including, in some cases, claims that the government will pay to replace your induction stove, water heater, gas furnace with more efficient and all-electric options) consumers should realize that the details of many those programs have been left to states to implement, many will have income qualification requirements, and most critically, will only apply to existing homes. Even an expanded personal income tax credit for energy efficiency upgrades–a common source of questions for us among Deltec customers–is specifically applicable only to existing homes, and not to new construction.

However, there are improved rebates available specifically for newly constructed homes as well, and they, too, are more generous now that the IRA has passed. But they are also not simple, and critically, most are not targeted at homeowners directly, though homeowners will still benefit.

The IRA’s path for incentivizing energy efficient new construction (as opposed to renewable energy systems, which is discussed separately below) is a revised tax credit for builders, and is tied to participation in one of two third party green building certification programs.

The Expanded Federal 45L Tax Credit for Energy Efficient New Construction for Builders

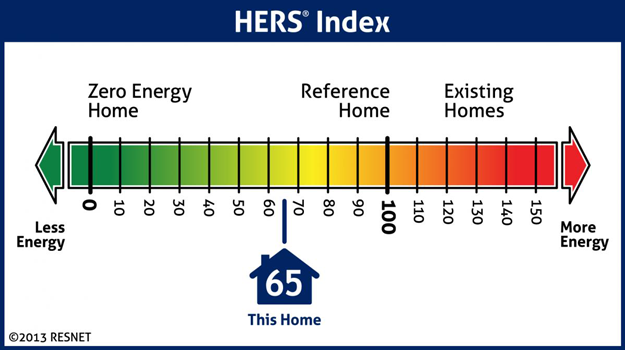

Historically, building companies that built new homes projected to have reductions in heating and cooling costs below a certain threshold (as measured by an energy model as part of getting a home HERS score) were eligible for a $2,000 business income tax credit per home through the 45L Business Tax Credit. Because qualifying for the tax credit requiring having a calculation performed, builders wouldn’t typically know if a project earned this credit or not until the end of year. Congress also had to re-authorize this tax credit separately every year—something that was often uncertain until actual year-end.

Going forward from 2023, and for 10 years without need for congressional re-authorization each year, this tax credit (still called the 45L tax credit) has changed. Builders can now earn a $2500 income tax credit for every certified Energy Star Home they build, or a $5,000 income tax credit for every DOE Zero Energy Ready Home.

Energy Star for Homes and the DOE Zero Energy Ready Home are both federally run green certification programs, and If you’ve visited this blog before, you’ll know that we talk a lot about the value of such programs for homeowners and builders alike. Earning these labels is not automatic—it still requires hiring an Energy Rater during the build process and following each program’s requirements during design and construction, and testing the home at the end, which typically incurs some construction costs in the form of hiring the Energy Rater to oversee the program, and potentially upgrading the specifications of the home from code minimums in your area. For the latter, we find that most Deltec homeowners are interested in specs for their home that already do that, and as for the former—the tax credit is one way that projects can potentially more than offset those costs.

Even though homeowners themselves do not receive this tax credit, they can benefit from the quality assurance, resale value, and science-backed best practices provided by those programs. Builders benefit too, in the form of reduced callbacks and comfort complaints from homeowners, marketing credentials—and now this expanded business income tax credit. The expansion of this tax credit is likely to drive expanded interest in green building among builders, which in turn can drive expanded use of and experience with green building and building science in the industry. This too, only benefits homeowners looking to build a new home that works the best that it can.

Renewed Solar Energy and Geothermal Heat Pump Tax Credit for Homeowners

The IRA also expanded a very popular income tax credit for solar electric, solar hot water, wind, and geothermal heat pump systems, one that has been in use since 2006 but was starting to sunset in recent years. As of 2023, the Federal Renewable Energy Tax Credit has been renewed for another 10, offering a 26-30% income tax credit for the costs of installing one of these system types. Unlike other IRA provisions, which, as discussed above, apply specifically to either new homes or to existing homes but not both, this tax credit applies equally to a new construction project or to adding these technologies to an existing home, and unlike the 45L tax credit for energy efficient new construction, this is a personal income tax credit for the homeowner, not the builder.

What About Other Incentives for Green Building?

Outside of the federal government, there were already a variety of incentives for energy efficient building from state, utility, or local governments. This database, maintained by the North Carolina Solar Center, is the most comprehensive tool for researching rebates, incentives, and government policies to incentivize energy efficiency and renewable energy across the country.

We have seen that incentive availability varies widely across the country, with investor-owned utilities, and more populous areas, more likely to have incentive programs available than rural areas or areas served by electric cooperatives. Utilities are the most likely entity, after the federal government, to offer incentives, although, like the IRA programs, utilities are more likely to reward only upgrades to existing homes, and fewer have programs that apply to new construction.

However, there are some noteworthy new construction utility programs out there. Here are few that our clients living in eligible areas have taken advantage of:

Duke Energy Progress/Duke Energy Carolinas Residential New Construction Rebate: Available in parts of North Carolina, and very recently added to parts of South Carolina, this program offers a rebate of 70 to 90 cents per kilowatt hour of energy saved, based on a HERS energy model, up to $6,000 to $9,000 (depending on whether your build site makes you a Duke Energy Progress, or a Duke Energy Carolinas customer.) Although this rebate is for builders, owner-builders are allowed to participate.

Duke Energy also offers a 5% energy rate discount to homeowners living in certified Energy Star homes in North and South Carolina.

Efficiency Vermont Residential New Construction Program offers technical assistance, a whole-home certification program and up to $6000 incentive for certifying to it, incentives for specific upgrades such as drain-waste heat recovery, balanced heat recovery ventilation, or all-electric construction. Incentives go to builders, owner-builders possibly being eligible.

Wisconsin Focus on Energy offers a cash incentive to builders who build to the Focus on Energy certification standards, potentially including owner-builders.

Build Green New Mexico: New Mexico offers a a Sustainable Building Tax Credit for homes and commercial buildings earning either LEED Certification or Build Green New Mexico certification. This tax credit appears to be available to both homeowners and builders of new homes.

A Reminder: Deltec Offers a Rebate of our Own

Third party green building certification is such a great way to ensure quality in our projects that we at Deltec offer our own rebate to customers and their builders who get a green building certification—and this one DOES go to the homeowner! You can read the details of that program here.

The Bottom Line

The IRA has expanded previous tax credits available for new green building in ways that are relevant to those building new homes—but the devil is in the details, because the programs available for new construction are different than the ones touted for upgrading existing homes. Federal incentives align with participation in two federal green building programs: Energy Star for Homes or the DOE Zero Energy Ready Home, and qualifying for these programs likely requires designing in some of the same energy efficiency upgrades from the getgo. Many Deltec homes have been built to these standards, in fact, many of our customers are already interested in getting that level of performance in their new home.